Patria Investments (PAX)·Q4 2025 Earnings Summary

Patria Q4 2025 Earnings: All Targets Met, Aggressive Capital Return

February 3, 2026 · by Fintool AI Agent

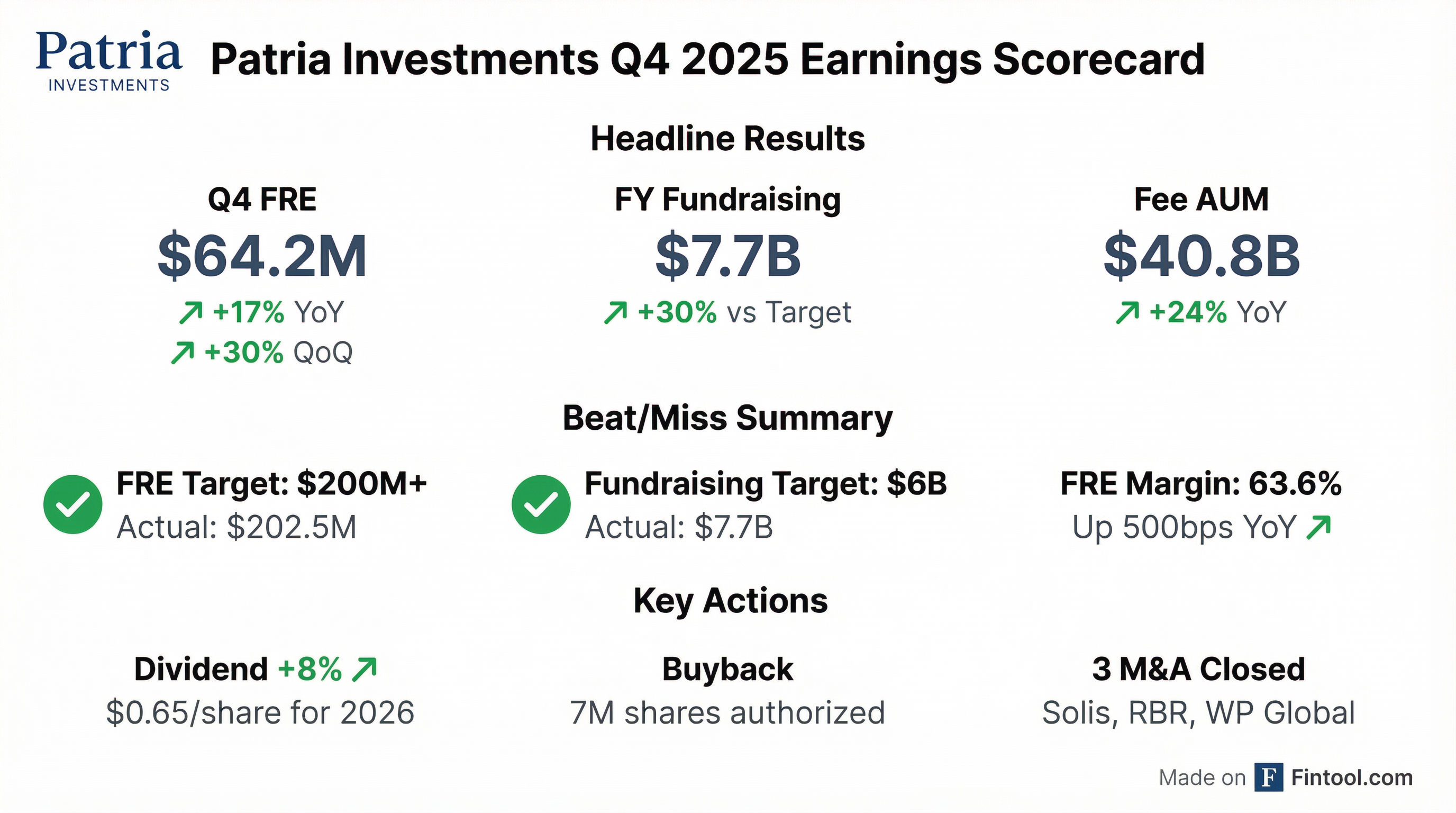

Patria Investments (PAX) delivered a capstone quarter to close 2025, with record fundraising of $7.7B crushing the $6B target by 30%, and full-year fee-related earnings of $202.5M meeting guidance. Management responded with an 8% dividend increase and announced a 7M share buyback program, including a 2.5M share commitment from Patria Partners.

The Latin America-focused alternative asset manager enters 2026 with pro forma fee-earning AUM of $47.4B following three acquisitions, positioning the firm for its $70B AUM target by year-end 2027.

Did Patria Beat Earnings?

Patria delivered across all key metrics, with FRE and fundraising both exceeding targets:

Values retrieved from S&P Global and earnings transcript

Full Year 2025 Performance:

- FRE: $202.5M (up 19% YoY, met $200M+ guidance)

- Fundraising: $7.7B organic (+30% vs. $6B target)

- Distributable Earnings: $200.9M, or $1.27/share (+6% YoY)

CEO Alexandre Saigh emphasized the outperformance: "We are very excited to report our fourth quarter results, a capstone to a very successful 2025, which highlights how, as we enter 2026, Patria is in a strong position to achieve and hopefully exceed the three-year objectives."

How Did the Stock React?

PAX opened up ~3% at $15.43 following the earnings release but gave back gains during the session, trading at ~$14.55 (-2.5%) intraday. The stock has rallied 55% from its 52-week low of $9.43 and trades 18% below its 52-week high of $17.80.*

Values retrieved from S&P Global

The selloff likely reflects profit-taking after the strong run into earnings and mixed signals on performance fees, with Private Equity Fund V falling out of carry.

What Did Management Guide?

Patria maintained its 3-year strategic targets while expressing increased confidence in execution:

Capital Return Program:

- Dividend: Increased 8% to $0.65/share for 2026 (from $0.60)

- Buyback: Additional 3M shares authorized (on top of existing 1.5M remaining)

- Patria Partners: Committed to purchase up to 2.5M PAX shares

- Total Authorization: Up to 7M shares available for repurchase

CFO Ana Russo provided context on cash generation: "Based on the midpoint of our 2026 FRE guidance and expected PRE, we estimate our cash generation in 2026 will be approximately $220 million."

What Changed From Last Quarter?

M&A Acceleration

After a 2025 "hiatus" focused on integration, Patria announced three acquisitions in rapid succession:

- Solis (closed Jan 2, 2026): 51% stake in Brazilian private credit manager with $3.5B fee-earning AUM. Pro forma credit vertical AUM: ~$12.1B

- RBR REITs (closed Feb 2, 2026): ~$1.3B permanent capital real estate assets. Now largest listed REIT manager in Brazil with $5.7B pro forma AUM

- WP Global Partners (signed): US lower middle market PE solutions manager with $1.8B fee-earning AUM

Pro forma fee-earning AUM post-acquisitions: $47.4B (vs. $40.8B reported)

Private Credit Opportunity

Management highlighted Brazil's private credit market as a major growth driver:

- Total Brazilian credit market: $1.7T

- Addressable market for private credit: $800B

- CLO AUM in Brazil: $150B+ (30%+ CAGR since 2019)

Net Accrued Performance Fees Decline

Net accrued performance fees dropped from $402M (Q3) to $249M (Q4), primarily due to Private Equity Buyout Fund V falling out of carry.

Key context: "If we consider the FX rate and the price of the public holdings by end of January, net accrued performance fees for Fund V would have been around $40 million."

Fundraising Breakdown by Asset Class

Organic fundraising of $7.7B in 2025 was driven by infrastructure, credit, and GPMS:

Geographic fundraising trends:

- Outperforming: Latin America, Asia Pacific, Middle East

- In-line: Europe

- Underperforming: United States

CEO Saigh on LatAm momentum: "We see these geopolitical shifts in the world benefiting LatAm... a region that was underrated for so many years, and now is getting its place under the sun."

Key Management Quotes

On Confidence in Targets:

"We are now even more confident of our ability to achieve our objectives for 2026 and 2027... Our success this year demonstrates that the strategic investments we made across our investment platforms, products, and distribution capabilities are paying off." — Ana Russo, CFO

On Performance Fees Predictability:

"When I look into management fees, the predictability is given that 22% of fee-paying AUM is now permanent capital structures... I can say with more confidence that our predictability of our management fees and therefore our FRE is more visible." — Alexandre Saigh, CEO

On Private Equity Valuation Process (addressing investor concerns):

"We use industry practice... Once a year, we have an independent appraiser to value the funds... We do not charge management fees on NAV for the drawdown funds. So the valuation does not affect our management fees." — Alexandre Saigh, CEO

Q&A Highlights

Craig Siegenthaler (Bank of America) — Private Equity Valuation

Q: Can you talk about your internal valuation process for PE Funds 4 and 5?

A: Management confirmed annual independent appraisals using DCF methodology, with valuations compared against peer multiples. Importantly, valuations don't impact management fees (charged on cost) or bonuses (only paid on realized performance fees).

Lindsey Shemma (Goldman Sachs) — Fundraising Outlook

Q: Why maintain 2026 fundraising guidance at $7B after exceeding targets in 2025?

A: Conservative approach—management wants to deliver the 3-year plan of $21B cumulative before upsizing. "Let us go through the first one or two quarters of 2026, then... if we feel even more confident, we'll come out with a new number."

Fernanda Sayão (JP Morgan) — Real Estate Strategy

Q: How dependent is the real estate business on lower rates?

A: Management acknowledged rate sensitivity but highlighted scale advantages as Brazil's largest REIT manager. Also noted asset-for-shares exchange opportunities and family inheritance planning as fundraising drivers beyond rate cycles.

CFO Transition

CFO Ana Russo announced her departure (effective April 2026), to be succeeded by Rafael Denadai, currently Partner and CFO of Portfolio Management with 25+ years of experience.

New Global COO Nikitas Tsilakis (from DWS Group) will strengthen operational execution at scale.

Forward Catalysts

- Q1-Q2 2026: Integration of Solis and RBR acquisitions; WP Global Partners closing

- 2026: Infrastructure Fund III monetizations expected to generate ~$20M in performance fees

- 2026: Private Equity Buyout Fund VI entering monetization phase ($210M+ net accrued carry)

- 2026: Trya energy trading platform growth; definitive agreement with Raízen to acquire Raízen Power

- End 2027: $70B fee-earning AUM target (currently $47.4B pro forma)

Risks Flagged

- FX Sensitivity: 60%+ of fee-earning AUM in hard currencies, but LatAm currency volatility can impact reported results

- PE Fund V Performance: Currently out of carry due to FX and public holdings marks; may fluctuate

- Performance Fee Volatility: Management emphasized $60M-$80M target for 2026-2027 is uncertain: "Things can happen and companies can perform better or worse."

- M&A Integration: Three acquisitions announced in quick succession may pressure near-term FRE margins

Bottom Line

Patria delivered a clean beat on fundraising and FRE while maintaining conservative 2026 guidance. The aggressive capital return program (8% dividend increase + 7M share buyback authorization) signals management confidence. The decline in net accrued performance fees and US underperformance in fundraising are headwinds, but the LatAm private credit opportunity and permanent capital growth provide a credible path to the $70B AUM target. Watch for integration execution on the three acquisitions and Infrastructure Fund III monetizations in 2026.